2 days ago | Martin R. Schreiber Advertisement

These exclusive offers despite ECB rate cuts are hard to find and require insider knowledge.

These exclusive offers despite ECB rate cuts are hard to find and require insider knowledge.

Anyone looking to secure these exceptional returns shouldn't wait too long, as interest rates are in a steep downward trend.

A handful of EU banks are desperately competing for customer deposits and are therefore paying extraordinary rates of up to 5.25% p.a. on GICs.

These exceptional conditions won't last long. Banks are already starting to pull these offers as the ECB continues its rate-cutting cycle.

With GICs (fixed bank deposits), you invest a fixed amount at a guaranteed interest rate for a specified term. Your capital remains secure, and the returns are calculable from the start. This investment form is particularly suitable for investors who value stability and predictability.

💡 "Fixed bank deposits continue to offer investors a stable and predictable return, which is particularly valued in uncertain times."

Throughout the EU, GIC investments are protected by statutory deposit insurance of up to 100,000 euros per customer and bank. This means that your money remains secure even in the unlikely event of a bank insolvency.

Despite the ECB's rate-cutting campaign, a select group of banks are still fighting to offer premium fixed-rate deals. We haven't seen opportunities like this since 2008.

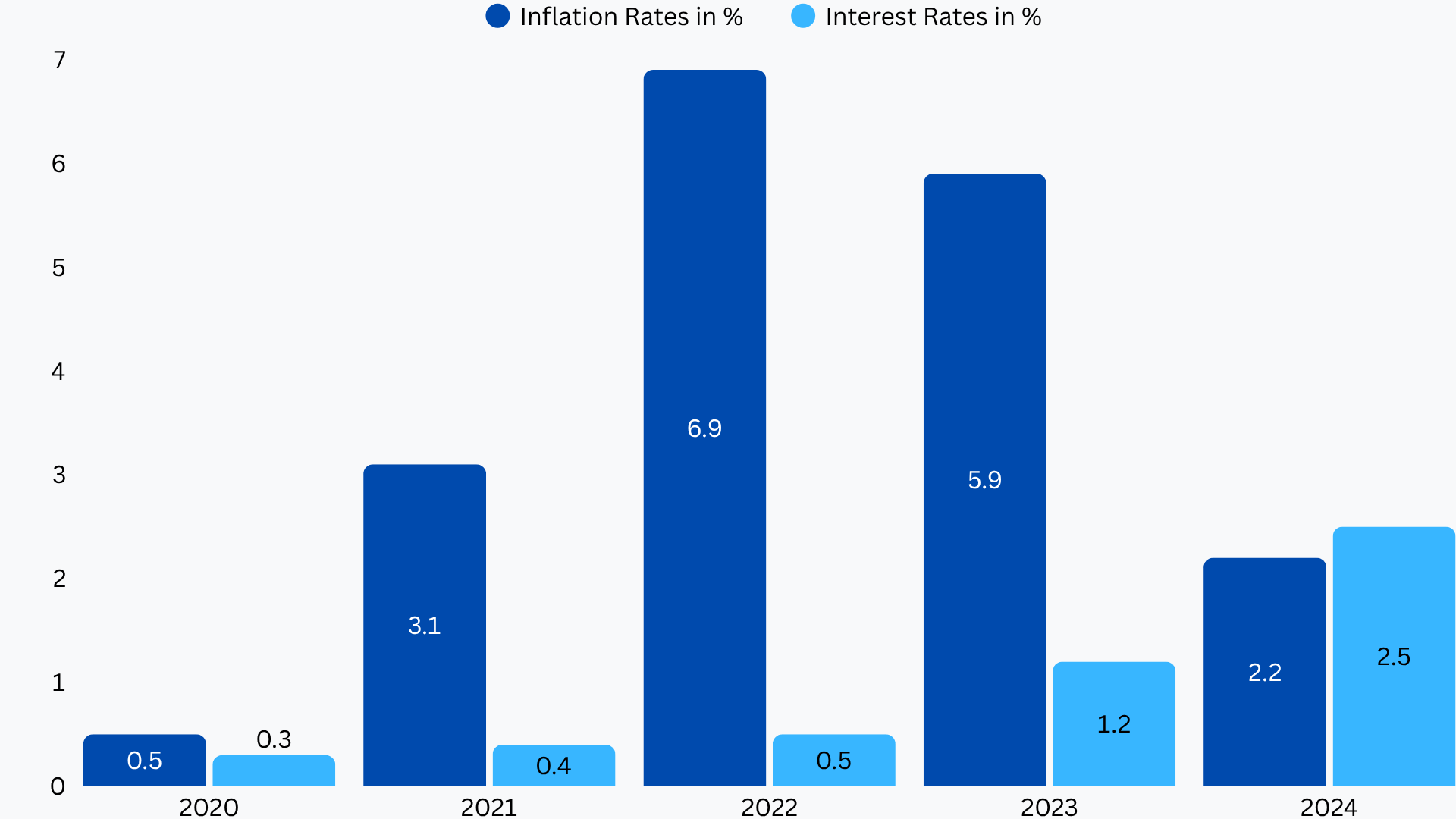

ECB key interest rate and inflation rate comparison – Source: German Federal Bank

ECB key interest rate and inflation rate comparison – Source: German Federal Bank

The chart illustrates: GICs currently still offer returns above the inflation rate. These attractive rates are driven primarily by banks that are currently in intense competition for fresh customer funds.

How long these exceptional rates will last is anyone's guess. That's why smart investors are locking in these rates before it's too late.

→ Top financial advisors are urging clients to act now on this rare opportunity:

“Only now, in 2025, do GIC interest rates offer a real chance to offset inflation. While inflation is continuously falling, interest rates have recently risen – but the ECB is already beginning with interest rate cuts. This rare overlap makes now the ideal time to secure attractive conditions before they fall again.”

Peter (60) and Susanne K. from Toronto

Peter (60) and Susanne K. from Toronto

Peter (60) and Susanne K. (56) from Toronto faced a problem: How should they invest their savings safely and profitably to remain financially worry-free in retirement?

“We were getting discouraged by the pathetic rates offered in Canada - most banks here barely pay 1-2%. Then we discovered this comparison platform that showed us European options we never knew we could access as Canadians.”

“Within hours, we had multiple offers on the table. We ended up choosing a 5.25% GIC that was significantly better than the 2.5% our local bank was offering.”

“Now we're earning real money on our savings instead of watching inflation eat away at our retirement fund. We wish we'd found this sooner.”

Attention: Don't fall for sketchy offers. This vetted comparison service works exclusively with rock-solid banks and top-tier EU partners to guarantee your capital stays protected.

The GIC market is flooding with options, but only insiders know which offers are actually worth your time.

These premium rates were once the exclusive domain of institutional investors. Now, for the first time, private investors can access the same deals with just €10,000.